UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [X](Amendment No. 1)

Filed by a Party other than the Registrant [ ]

| Filed by Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| Preliminary Proxy Statement | |

| ☐ | Confidential, for |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material |

DSS, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Feefiling fee (Check the appropriate box):

| No fee required. | ||

| Fee computed on table below per Exchange Act Rules 14a-6(i) | ||

| 1) | Title of each class of securities to which transaction applies: | |

| Aggregate number of securities to which transaction applies: | ||

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| Proposed maximum aggregate value of transaction: | ||

| Total fee paid: | ||

| ☐ | Fee paid previously with preliminary | |

| Check box if any part of the fee is offset as provided by Exchange Act Rule | ||

| 1) | Amount Previously Paid: | |

| Form, Schedule or Registration Statement No.: | ||

| Filing Party: | ||

| Date Filed: | ||

Copies to: Darrin M. Ocasio, Esq. Sichenzia Ross Ference, LLP 1185 Avenue of the Americas New York, NY 10036 Tel: (212)-930-9700 |

DSS, INC.

275 Wiregrass Pkwy

6 FRAMARK DRIVE,West Henrietta, New York 14586

VICTOR, NY 14564[ ], 2022

NOTICE OF 2021 ANNUALSPECIAL MEETING OF STOCKHOLDERS

TO BE HELD [______], 2022

[__] A.M. EASTERN STANDARD TIME

To ourOur Stockholders:

The 2021 Annual Meeting of Stockholders of DSS, Inc. (the “Company”) has entered into a Stock Purchase Agreement, dated February 28, 2022 (the “Stock Purchase Agreement”) with Alset EHome International, Inc. (“Alset EHome”) pursuant to which the Company will purchase 100% of the common stock of True Partner International Limited (the “True Partner International Common Stock”) and 62,122,908 shares of common stock, par value $0.01, of True Partner Capital Holding Limited, a Cayman Islands company (the “True Partner Common Stock,” and together with the True Partner International Common Stock, the “True Partner Shares”), “we”from Alset EHome (the “True Partner Transaction”).

Upon consummation of the True Partner Transaction (the “True Partner Closing”), “us”in exchange for the True Partner Shares, the Company will issue to Alset EHome, an aggregate of 17,570,948 newly issued shares of the Company’s common stock, par value $0.02 per share (the “DSS-TP Shares”).

Additionally, on February 25, 2022, the Company entered into an Assignment and Assumption Agreement wherein the Company agreed to purchase a Convertible Promissory Note between Alset International Limited, a Republic of Singapore limited company (“Alset International”) as lender and American Medical REIT, Inc., a Maryland corporation (“AMRE”) as borrower, with a principal amount of $8,350,000 and accrued but unpaid interest of $367,400 through May 15, 2022 (the “Note”), in exchange for the issuance of 21,366,177 shares of common stock of the Company at $0.408 per share, which equals $8,717,400, or “our”the aggregate amount due under the Note (the “AMRE Transaction”).

The Company is holding a special meeting of its stockholders in order to obtain the stockholder approvals necessary to complete the True Partner Transaction, Alset Singapore Transaction and related matters. The Special Meeting will be held on [___________] 2022, at [__] a.m., Eastern Time. The Special Meeting will held at 1400 Broadfield Blvd., Suite 100, Houston, TX 77084 on Tuesday, November 9, 2021,(the “Special Meeting”). The attached Notice of Special Meeting and Proxy Statement describes the business we will conduct at 9:00 am local time, for the purposes of:meeting and provides information about DSS Inc. that you should consider when you vote your shares.

At the Special Meeting, the Company’s stockholders will be asked:

| 1. | Issuance Proposal #1. To | |

| True Partner Transaction; | ||

| 2. | Issuance Proposal #2. To approve, the issuance of up to an aggregate of 21,366,177 shares of the Company’s common stock to Alset International Limited pursuant to the AMRE Transaction; | |

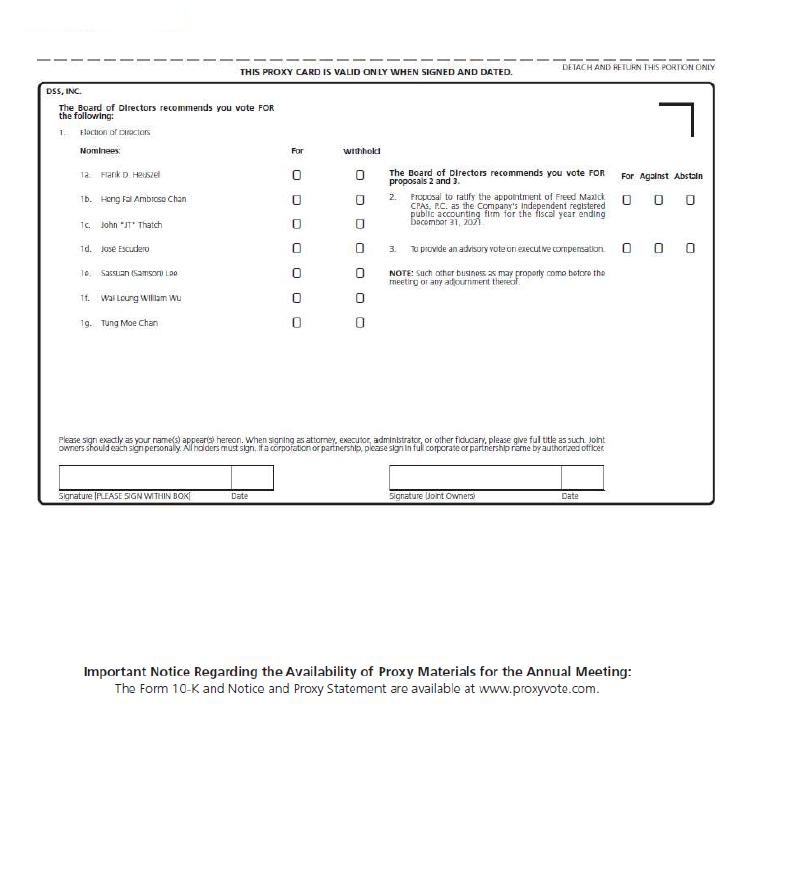

| 3. | Proposal # 3. Ratification of Auditors:To ratify the appointment of | |

| 4. | Proposal # 4. Amendment to Bylaws: Approval of an amendment to DSS, Inc.’s bylaws reducing the number of shares of common stock need for a quorum from a majority to thirty-five percent (35%); | |

| Proposal # 5. Amendment to Certificate of Amendment of Certificate of Incorporation: To | ||

| 6. | Proposal #5. 2020 Equity Incentive Plan Authorized Share Increase: To approve an amendment to the 2020 Employee, Director and Consultant Equity Incentive Plan (“2020 Equity Incentive Plan”) to increase the number of shares of common stock authorized to be issued pursuant to the 2020 Plan from [ ] shares to 20,000,000 shares. |

We also will transact such other business as may properly come before the meeting and any adjournments or postponements of the meeting. The foregoing items of business are described more fully described in the accompanying Proxy Statement accompanying this notice.

Statement. Any other business that may properly come before the Special Meeting will also be conducted. The Board of Directors has fixedis not aware of any other business to come before the close of business on September 14, 2021 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and at any adjournment or postponement thereof. These proxy materials will be mailed on or about September 30, 2021 to the stockholders of record on the record dateSpecial Meeting.

The BoardYour vote is very important, regardless of Directors recommendsthe number of shares you hold. Whether or not you plan to attend the meeting, please carefully review the enclosed Proxy Statement and then cast your vote.

We hope that you vote “FOR” the proposals set forth in this Notice of Annual Meeting of Stockholders and the Proxy Statement.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING: The Company’s Annual Reportwill join us on Form 10-K for the fiscal year ended December 31, 2020, and the Company’s Proxy Statement for the 2021 Annual Meeting of Stockholders, along with any amendments to the foregoing materials that are required to be furnished to stockholders, will be available at www.proxyvote.com.[_________], 2022.

| /s/ Heng Fai Ambrose Chan | ||

Name: | Heng Fai Ambrose Chan | |

| Title: | Chairman of the Board | |

DSS, INC.

275 Wiregrass Pkwy

West Henrietta, NY 14586

Notice of Special Meeting of Stockholders

To Be Held on [_____________], 2022

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the Special Meeting of Stockholders (the “Special Meeting”), of DSS, Inc. (the “Company”) will be held on [__________], 2022, at [__] a.m., Eastern Time, at 1400 Broadfield Blvd., Suite 100, Houston, TX 77084, for the following purposes:

| Date: | [_________], 2022 | |

| Time: | [___] Eastern Standard Time | |

| Place: | 1400 Broadfield Blvd., Suite 100, Houston, TX 77084 | |

| Purposes: | 1. | Issuance Proposal #1: To approve, the issuance of up to an aggregate of 17,570,948shares of the Company’s common stock to Alset EHome pursuant to the True Partner Transaction; |

| 2. | Issuance Proposal #2: To approve, the issuance of up to an aggregate of 21,366,177 shares of the Company’s common stock to Alset International Limited pursuant to the AMRE Transaction; | |

| 3. | Ratification of Auditors: To ratify the appointment of Turner, Stone & Company, L.L.P.as the Company’s independent registered public accounting firm for the fiscal years ending December 31, 2021 and December 31, 2022; | |

| 4. | Approval of an amendment to the Bylaws of DSS, Inc.: To approve the amendment of the Bylaws of DSS Inc. to change the quorum requirement from a majority of the stock issued and outstanding, either in person or by proxy, to at least thirty-five percent (35%) of the stock issued and outstanding, either in person or by proxy; and | |

| 5. | Proposal # 5. Amendment to Certificate of Amendment of Certificate of Incorporation: To approve an amendment to the Company’s Certificate of Amendment of Certificate of Incorporation, as amended (the “Certificate of Incorporation”) to increase the total number of shares of the Company’s authorized common stock; and | |

| 6. | Approval of 2020 Equity Incentive Plan authorized share increase: To approve an amendment to the 2020 Employee, Director and Consultant Equity Incentive Plan (“2020 Equity Incentive Plan”) to increase the number of shares of common stock authorized to be issued pursuant to the 2020 Plan from [ ] shares to 20,000,000 shares. | |

| Record Date: | The Board of Directors has fixed the close of business on April 5, 2022 as the record date for determining stockholders entitled to notice of, and to vote at, the Special Meeting or any adjournment or postponement thereof. |

WHETHER OR NOT YOU PLAN ON ATTENDING THE ANNUAL MEETING IN PERSON, PLEASE VOTE AS PROMPTLY AS POSSIBLE TO ENSURE THAT YOUR VOTE IS COUNTED.+The Company has enclosed a copy of the proxy statement and the proxy card. The proxy statement, the proxy card and the Annual Report are also available on the Company’s website at [___].

Your vote is important. Whether or not you plan to attend the meeting, we urge you to vote as soon as possible by submitting your proxy. You may vote your proxy three different ways: by mail, via the Internet, or by telephone. You may also be entitled to vote in person at the meeting. Please refer to detailed instructions included in the accompanying proxy statement.

| FOR THE BOARD OF DIRECTORS | |

| /s/ Heng Fai Ambrose Chan | |

| Heng Fai Ambrose Chan | |

| Chairman of the Board |

West Henrietta, New York

March [__], 2022

DSS, INC.

275 Wiregrass Pkwy

West Henrietta, NY 14586

Table of ContentsPROXY STATEMENT

SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON [____________], 2022

TABLE OF CONTENTS

| 4 |

DSS, INC.Proxy Solicitation and General Information

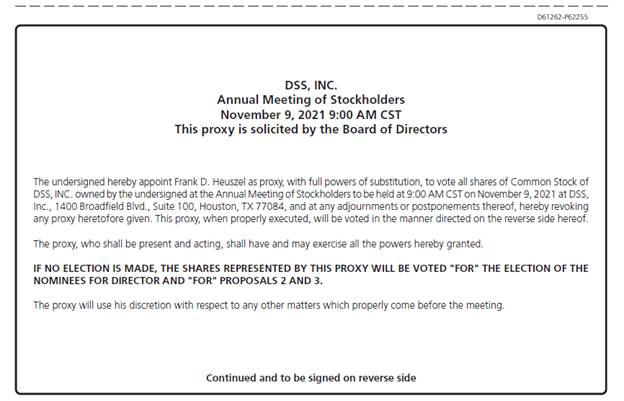

6 FRAMARK DRIVEThis Proxy Statement and the enclosed form of proxy card (the “Proxy Card”) are being furnished to the stockholders of DSS, Inc., a New York corporation (the “Company,” “we,” “us” or “our”), in connection with the solicitation of proxies by our Board of Directors for use at the Special Meeting of Stockholders to be held on [__________], 2022, at [ ] a.m., Eastern Time, 1400 Broadfield Blvd., Suite 100, Houston, TX 77084 (the “Special Meeting”). Accordingly, we encourage stockholders to vote either online or by mailing their proxy card as described below.

At the Special Meeting, stockholders will be asked:

| 1. | Issuance Proposal #1: To approve, the issuance of up to an aggregate of 17,570,948shares of the Company’s common stock to Alset EHome pursuant to the True Partner Transaction; |

| 2. | Issuance Proposal #2: To approve, the issuance of up to an aggregate of 21,366,177 shares of the Company’s common stock to Alset International Limited pursuant to the AMRE Transaction; |

| 3. | Ratification of Auditors: To ratify the appointment of Turner, Stone & Company, L.L.P.as the Company’s independent registered public accounting firm for the fiscal years ending December 31, 2021 and December 31, 2022; |

| 4. | Amendment to Bylaws: To approve an amendment to the bylaws of DSS, Inc. to change the quorum requirement from a majority of the stock issued and outstanding, either in person or by proxy, to at least thirty-five percent (35%) of the stock issued and outstanding, either in person or by proxy; |

| 5. | Amendment to Certificate of Amendment of Certificate of Incorporation: To approve an amendment to the Company’s Certificate of Amendment of Certificate of Incorporation, as amended (the “Certificate of Incorporation”) to increase the total number of shares of the Company’s authorized common stock; and |

| 6. | Approval of 2020 Equity Incentive Plan authorized share increase: To approve an amendment to the 2020 Employee, Director and Consultant Equity Incentive Plan (“2020 Equity Incentive Plan”) to increase the number of shares of common stock authorized to be issued pursuant to the 2020 Plan from [ ] shares to 20,000,000 shares. |

| The Board of Directors has fixed the close of business on April 5, 2022 as the record date for determining stockholders entitled to notice of, and to vote at, the Special Meeting or any adjournment or postponement thereof. |

VICTOR, NEW YORK 14564Voting Rights and Votes Required

PROXY STATEMENT FOR THE COMPANY’S

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 9, 2021

Date, TimeThe close of business on April 5, 2022 has been fixed as the record date for the determination of stockholders entitled to receive notice of and Place

We are furnishing this proxy statement (the “Proxy Statement”) to vote at the holdersSpecial Meeting. As of the close of business on such date, we had outstanding and entitled to vote [________] shares of our common stock, par value $0.02 per share. You may vote your shares of common stock in person or by proxy. You may submit your proxy by telephone, via the internet or by completing the enclosed proxy card and mailing it in the envelope provided. Stockholders who hold shares in “street name” should refer to their proxy card or the information forwarded by their bank, broker or other nominee for instructions on the voting options available to them. To vote in person, you may attend the Special Meeting and deliver your completed proxy card electronically or vote your shares in-person during the meeting.

The presence at the Special Meeting, whether in person or by valid proxy, of a majority of the shares of our common stock entitled to vote will constitute a quorum, permitting us to conduct our business at the Special Meeting. The record holder of each share (the “Common Stock”of common stock entitled to vote at the Special Meeting will have one vote for each share so held. Abstentions and broker non-votes will count for quorum purposes.

If a broker that is a record holder of common stock does not return a signed proxy, the shares of common stock represented by such proxy will not be considered present at the Special Meeting and will not be counted toward establishing a quorum. If a broker that is a record holder of common stock does return a signed proxy, but is not authorized to vote on one or more matters (with respect to each such matter, a “broker non-vote”), the shares of common stock represented by such proxy will be considered present at the Special Meeting for purposes of determining the presence of a quorum. A broker that is a member of the New York Stock Exchange is prohibited, unless the stockholder provides the broker with written instructions, from giving a proxy on non-routine matters. Consequently, your brokerage firm or other nominee will have discretionary authority to vote your shares with respect to routine matters but may not vote your shares with respect to non-routine matters.

| 5 |

Voting of Proxies

Most stockholders have three ways to submit a proxy: by telephone, via the Internet or by completing the enclosed proxy card and mailing it in connectionthe envelope provided. To submit a proxy by telephone or via the Internet, follow the instructions set forth on each proxy card you receive. To submit a proxy by mail, sign and date each proxy card you receive, mark the boxes indicating how you wish to vote and return the proxy card in the postage-paid envelope provided. Do not return the proxy card if you submit your proxy via the Internet or by telephone.

Our Board of Directors recommends a vote FOR the each of the proposals set forth in the Notice of Special Meeting of Stockholders and the Proxy Statement.

Revocation of Proxies

Any proxy given pursuant to this solicitation may be revoked by a stockholder at any time before it is exercised by providing written notice to our Secretary at DSS, Inc., 275 Wiregrass Pkwy, West Henrietta, New York, 14586 by delivery to us of a properly executed proxy bearing a later date, or by attending the meeting and voting in person at the Special Meeting.

Solicitation of Proxies

We will bear the cost of this solicitation, including amounts paid to banks, brokers and other nominees to reimburse them for their expenses in forwarding solicitation materials regarding the Special Meeting to beneficial owners of our common stock. The solicitation will be by mail, with the materials being forwarded to stockholders of record and certain other beneficial owners of our common stock, and by our officers and other regular employees (at no additional compensation). We have not engaged a proxy solicitor to distribute our proxy materials and solicit proxies. Our officers and employees may solicit proxies from stockholders by personal contact, by telephone, or by other means if necessary in order to assure sufficient representation at the Special Meeting.

The Company has engaged Alliance Advisors LLC, to assist in the solicitation of proxies on behalfand provide related advice and informational support, for a services fee, plus customary disbursements, which are not expected to exceed $25,000 in total.

American Stock Transfer & Trust Company is our transfer agent.

American Election Services, LLC shall act as inspector of the Board of Directors (the “Board”) of DSS, Inc. (together with its consolidated subsidiaries (unless the context otherwise requires), referred to herein as “DSS,” “we,” “us,” “our” or the “Company”) for useelections at the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at 1400 Broadfield Blvd., Suite 100, Houston, TX 77084, on November 9, 2021,Special Meeting.

Questions and any adjournment thereof. On September 30, 2021, the Company effected a merger pursuant to which the Company and its wholly-owned subsidiary, DSS, Inc., merged. Following the merger, the Company was the surviving corporation and the Company’s name was amended from Document Security Systems, Inc. to DSS, Inc.Answers

MattersThe following are some questions that you, as a stockholder of the Company, may have about the Special Meeting, the proposals being considered at the Special Meeting, as applicable, and brief answers to those questions. These questions and answers may not address all questions that may be Consideredimportant to you as a stockholder of the Company. We encourage you to read carefully the more detailed information contained elsewhere in this proxy statement.

| Q: | Why am I receiving this proxy statement? |

The Annual Meeting will be held for the following purposes:

| A: | These proxy materials describe the proposals on which the Company would like you to vote and also give you information on these proposals so that you can make an informed decision. We are furnishing our proxy materials to all stockholders of record entitled to vote at the Special Meeting. As a stockholder, you are invited to attend the Special Meeting and are entitled and requested to vote on the proposals described in this proxy statement. |

| Q: | When and where is the Special Meeting? |

| A: | The Meeting will take place on [________], 2022, starting at [ ], Eastern Time at 1400 Broadfield Blvd., Suite 100, Houston, TX 77084. |

| Q: | Who is entitled to vote at the Special Meeting? |

| A: | Only stockholders who our records show owned shares of our common stock as of the close of business on April 5, 2022, which is the record date for the Special Meeting (the “Record Date”), may vote at the Special Meeting. You will have one vote for each share of the Company’s common stock that you owned as of the Record Date. On the Record Date, we had [__] shares of common stock outstanding. |

| Q: | How are votes counted? |

| A: | Each share of our common stock entitles its holder to one vote per share. |

| 6 |

| Q: | What am I being asked to vote on? |

| A: | You will be voting on the following proposals. |

| 1. | Issuance Proposal #1. To | |

| 2. | Issuance Proposal #2. To approve, the issuance of up to an aggregate of 21,366,177 shares of the Company’s common stock to Alset International Limited pursuant to the AMRE Transaction; | |

| 3. | Ratification of Auditors: To ratify the appointment of | |

As of the date of this Proxy Statement, the Board is not aware of any other matters that will come before the Annual Meeting. However, if any other matters properly come before the Annual Meeting, the persons named as proxies will vote on them in accordance with their best judgment.

Important Notice Regarding the Availability of this Proxy Statement

We have opted to provide our materials pursuant to the full set delivery option in connection with the Annual Meeting. Under the full set delivery option, a Company delivers all proxy materials to its stockholders. The approximate date on which this Proxy Statement and form of proxy are first being provided to stockholders, or being made available through the Internet for those stockholders receiving their proxy materials electronically, is October 1, 2021. This delivery can be by mail or, if a stockholder has previously agreed, by e-mail. In addition to delivering proxy materials to stockholders, the Company must also post all proxy materials on a publicly accessible website and provide information to stockholders about how to access that website. Accordingly, you should have received our proxy materials by mail or, if you previously agreed, by e-mail. These proxy materials include the Notice of Annual Meeting of Stockholders, Proxy Statement, and proxy card. These materials are available free of charge at www.proxyvote.com

Any stockholder executing a proxy that is solicited has the power to revoke it prior to the voting of the proxy. Revocation may be made by i) attending the Annual Meeting and voting the shares of stock in person, ii) delivering to the Secretary of the Company at the principal office of the Company prior to the Annual Meeting a written notice of revocation or a later-dated, properly executed proxy, iii) signing another proxy card with a later date and returning it before the polls close at the Annual Meeting, or iv) voting again via the internet or by toll free telephone by following the instructions on the proxy card.

GENERAL INFORMATION ABOUT VOTING

Only the holders of record of our Common Stock at the close of business on the record date, September 14, 2021 (the “Record Date”), are entitled to notice of and to vote at the meeting. On the Record Date, there were 79,745,886 shares of our Common Stock outstanding. Stockholders are entitled to one vote for each share of Common Stock held on the Record Date.

Quorum

At all meetings of the Board, the presence at the commencement of a meeting of shareholders of the Company in person or by proxy of shareholders holding of record a majority of the total number of shares of the Company then issued and outstanding and entitled to vote shall be necessary and sufficient to constitute a quorum for the transaction of any business.

When a proxy is properly executed and returned (and not subsequently properly revoked), the shares it represents will be voted in accordance with the directions indicated thereon, or, if no direction is indicated thereon, it will be voted:

| 6. | Approval of 2020 Equity Incentive Plan authorized share increase: To approve | |

| The Board of Directors has fixed the close of business on [ ], 2022 as the record date for determining stockholders entitled to notice of, and to vote at, the Special Meeting or any adjournment or postponement thereof. |

| Q: | How does the Company’s Board of Directors recommend that I vote on the proposals set forth in the Notice of Special Meeting of Stockholders and the Proxy Statement? |

| A: | Our Board of Directors recommends that you vote “FOR” each of the proposals set forth in the Notice of Special Meeting of Stockholders and the Proxy Statement. |

| Q: | Do I have dissenters’ rights if I vote against the proposals? |

| A: | There are no dissenters’ rights available to the Company’s stockholders with respect to any matter to be voted on at the Special Meeting. |

| Q: | What do I need to do now? |

| A: | We encourage you to read this entire proxy statement, and the documents we refer to in this proxy statement Then complete, sign, date and return, as promptly as possible, the enclosed proxy card in the accompanying reply envelope or grant your proxy electronically over the Internet or by telephone, so that your shares can be voted at the Special Meeting. If you hold your shares in “street name,” please refer to the voting instruction forms provided by your broker, bank or other nominee to vote your shares. |

| Q: | What quorum is required for the Special Meeting? |

| A: | A quorum will exist at the Special Meeting if the holders of record of a majority of the issued and outstanding shares of the Company’s common stock are present in person or by proxy. Shares of the Company’s common stock that are voted to abstain are treated as shares that are represented at the Special Meeting for purposes of determining whether a quorum exists; broker non-votes are not counted for the purpose of determining the presence of a quorum at the Special Meeting as the Proposals to be considered would not be evaluated as routine by the NYSE. |

| Q: | Who will tabulate the votes? |

| A: | American Election Services, LLC will assist in the solicitation of proxies and act as inspector of elections at the Special Meeting. |

| Q: | What vote is required in order for the proposals to be approved? |

| A: | The following table sets forth the required vote for each proposal: |

| Proposal | Required Vote | |||

| 1. | To approve, the issuance of up to an aggregate of 17,570,948shares of the Company’s common stock to Alset EHome pursuant to the True Partner Transaction | Majority of the shares present In-person or by proxy | ||

| 2. | To approve, the issuance of up to an aggregate of 21,366,177 shares of the Company’s common stock to Alset International Limited pursuant to the AMRE Transaction; | Majority of the shares present in-person or by proxy | ||

| 3. | To ratify the appointment of Turner, Stone & Company, L.L.P. as the Company’s independent registered public accounting firm for the fiscal years ending December 31, 2021 and December 31, 2022; | Majority of the shares present in-person or by proxy | ||

| 4. | To approve an amendment to the bylaws of DSS, Inc. to change the quorum requirement from a majority of the stock issued and outstanding, either in person or by proxy, to at least thirty-five percent (35%) of the stock issued and outstanding, either in person or by proxy; | Majority of the shares present in-person or by proxy | ||

| 5. | To approve an amendment to the Company’s Certificate of Amendment of Certificate of Incorporation, as amended (the “Certificate of Incorporation”) to increase the total number of shares of the Company’s authorized common stock; and | Majority of the outstanding shares | ||

| 6. | To approve an amendment to the 2020 Employee, Director and Consultant Equity Incentive Plan (“2020 Equity Incentive Plan”) to increase the number of shares of common stock authorized to be issued pursuant to the 2020 Plan from [ ] shares to 20,000,000 shares. | Majority of the shares present in-person or by proxy |

Director nominees must receive a majority of the votes cast on such director’s election, which means that the nominee must receive more “FOR” votes than “WITHHOLD” votes.

| Q: | What are broker non-votes? |

| A: | Broker non-votes are shares held by brokers that do not have discretionary authority to vote on the matter and have not received voting instructions from their clients. Brokers holding shares of record for customers generally are not entitled to vote on “non-routine” matters, unless they receive voting instructions from their customers. Proposals 1 and 2 to approve the issuance of shares pursuant to the described transactions, Proposal 4, to approve an amendment to the bylaws, Proposal 5, to approve an amendment to the Certificate of Incorporation; and Proposal 6, to approve an amendment to the 2020 Equity Incentive Plan to increase the number of shares authorized to be issued under the 2020 Plan, and any adjournments thereof are “non-routine matters.” Proposal 3 to ratify the Auditors is a “routine” matter.

The determination of “routine” and “non-routine” matters is determined by brokers and those firms responsible to tabulate votes cast by beneficial owners of shares held in street name and other nominees. Firms casting such votes have generally been guided by rules of the New York Stock Exchange when determining if proposals are considered “routine” or “non-routine”. When a matter to be voted on is the subject of a contested solicitation, banks, brokers and other nominees do not have discretion to vote your shares with respect to any proposal to be voted on. |

| Q: | How do I vote my shares if I am a record holder? |

| A: | If you are a record holder of shares (that is, the shares are registered with our transfer agent in your name and not the name of your broker or other nominee), you are urged to submit your proxy as soon as possible, so that your shares can be voted at the meeting in accordance with your instructions. Registered stockholders have three ways to submit a proxy: by telephone, via the Internet or by completing the enclosed proxy card and mailing it in the envelope provided. To submit a proxy by telephone or via the Internet, follow the instructions set forth on each proxy card you receive. To submit a proxy by mail, sign and date each proxy card you receive, mark the boxes indicating how you wish to vote and return the proxy card in the postage-paid envelope provided. Do not return the proxy card if you submit your proxy via the Internet or by telephone. |

| Q: | How do I vote my shares if I hold my shares in “street name” through a bank, broker or other nominee? |

| A: | If you hold your shares as a beneficial owner through a bank, broker or other nominee, you should have received instructions on how to vote your shares from your broker, bank or other nominee. Please follow their instructions carefully. You must provide voting instructions to your bank, broker or other nominee by the deadline provided in the materials you receive from your bank, broker or other nominee to ensure your shares are voted in the way you would like at the Special Meeting. Also, if you wish to vote in person at the Special Meeting, you must request a legal proxy from the bank, broker or other nominee that holds your shares and present that proxy and proof of identification at the Special Meeting. |

| 8 |

| Q: | If my bank, broker or other nominee holds my shares in “street name,” will such party vote my shares for me? |

| A: | For all “non-routine” matters, not without your direction. Your broker, bank or other nominee will be permitted to vote your shares on any “non-routine” proposal only if you instruct your broker, bank or other nominee on how to vote. Under applicable stock exchange rules, brokers, banks or other nominees have the discretion to vote your shares on routine matters if you fail to instruct your broker, bank or other nominee on how to vote your shares with respect to such matters. The proposals to be voted upon by our stockholders described in this proxy statement, except for the ratification of the appointment of our independent registered public accounting firm, are “non-routine” matters, and brokers, banks and other nominees therefore cannot vote on these proposals without your instructions. You should follow the procedures provided by your broker, bank or other nominee regarding the voting of your shares of the Company’s common stock. Without instructions, a broker non-vote will result, and your shares will not be voted, on all “non-routine” matters. |

| Q: | What is a proxy? |

| A: | A proxy is your legal designation of another person, referred to as a “proxy,” to vote shares of stock. The written document describing the matters to be considered and voted on at the Special Meeting is called a “proxy statement.” |

| Q: | If a stockholder gives a proxy, how are the shares voted? |

| A: | When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Special Meeting in accordance with the instructions of the stockholder. If no specific instructions are given on properly-executed returned proxies, however, the shares will be voted in accordance with the recommendations of our Board of Directors as described above. If any matters not described in this proxy statement are properly presented at the Special Meeting, the proxy holders will use their own judgment to determine how to vote your shares. |

| Q: | What happens if I do not vote or return a proxy? |

| A: | A quorum will exist at the Special Meeting only if the holders of record of a majority of the issued and outstanding shares of the capital stock of the Company entitled to vote at the Special Meeting are present in-person or by proxy. Your failure to vote on the proposals, by failing to either submit a proxy or attend the Special Meeting if you are a stockholder of record, may result in the failure of a quorum to exist at the Special Meeting. |

| Q: | What happens if I abstain? |

| A: | If you abstain, whether by proxy or in-person at the Special Meeting, or if you instruct your broker, bank or other nominee to abstain your abstention will not be counted for or against the proposals, but will be counted as “present” at the Special Meeting in determining whether or not a quorum exists. |

| Q: | Can I revoke my proxy or change my vote? |

| A: | You may change your vote at any time prior to the vote at the Special Meeting. To revoke your proxy instructions and change your vote if you are a holder of record, you must (i) vote again on a later date on the Internet or by telephone (only your latest internet proxy submitted prior to the Special Meeting will be counted), (ii) advise our Secretary at our principal executive offices (275 Wiregrass Pkwy, West Henrietta, New York, 14586) in writing before the proxy holders vote your shares, (iii) deliver later dated and signed proxy instructions (which must be received prior to the Special Meeting) or (iv) attend the Special Meeting and vote in-person. If you hold shares in “street name,” you should refer to the instructions you received from your broker, bank or other nominee. Attendance in and of itself at the Special Meeting will not revoke a proxy. For shares you hold beneficially but not of record, you may change your vote by submitting new voting instructions to your broker or nominee or, if you have obtained a valid proxy from your broker or nominee giving you the right to vote your shares, by attending the Special Meeting and voting. |

| 9 |

| Q: | What should I do if I receive more than one set of voting materials? |

| A: | You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please complete, date, sign and return (or vote via the Internet with respect to) each proxy card and voting instruction card that you receive to ensure that all of your shares are counted. |

| Q: | What is “householding”? |

| A: | We have adopted a procedure approved by the U.S. Securities and Exchange Commission (the “SEC”) called “householding” for stockholders who have the same address and last name and do not participate in electronic delivery of proxy materials. In some instances, only one copy of the proxy materials is being delivered to multiple stockholders sharing an address, unless we have received instructions from one or more of the stockholders to continue to deliver multiple copies. This procedure reduces our printing costs and postage fees. We will deliver promptly, upon oral or written request, a separate copy of the applicable materials to a stockholder at a shared address to which a single copy was delivered. If you wish to receive a separate copy of the proxy materials you may call us at [(___) _________] or send a written request DSS, Inc., 275 Wiregrass Pkwy, West Henrietta New York, 14586, Attention: Secretary. If you have received only one copy of the proxy materials, and wish to receive a separate copy for each stockholder in the future, you may call us at the telephone number or write us at the address listed above. Alternatively, stockholders sharing an address who now receive multiple copies of the proxy materials may request delivery of a single copy, also by calling us at the telephone number or writing to us at the address listed above. |

| Q: | Where can I find the voting results of the Special Meeting? |

| A: | The Company intends to announce preliminary voting results at the Special Meeting and publish final results in a Current Report on Form 8-K that will be filed with the SEC following the Special Meeting. All reports the Company files with the SEC are publicly available when filed |

| Q: | What if I have questions about lost stock certificates or need to change my mailing address? |

| A: | You may contact our transfer agent, American Stock Transfer and Trust Company, LLC at 1 (800) 937-5449 (U.S.) or by email at help@astfinancial.com. |

| Q: | Who can help answer my additional questions about the proposals or the other matters discussed in this proxy statement? |

| A: | If you have questions about the proposals or other matters discussed in this proxy statement, you may contact the Company by mail at DSS, Inc., 275 Wiregrass Pkwy, West Henrietta, New York, 14586, Attention: Secretary. |

| 10 |

PROPOSAL 1- ISSUANCE PROPOSAL TO APPROVE THE ISSUANCE OF UP TO 17,570,948 SHARES OF COMMON STOCK OF THE COMPANY IN CONNECTION WITH THE TRUE PARTNER TRANSACTION

We are asking our stockholders to approve the issuance of up to 17,570,948 Shares our Common Stock to Alset EHome International, Inc. (“Alset EHome”) pursuant to and upon the terms and subject to the conditions set forth in the Stock Purchase Agreement entered into by the Company and Alset EHome on February 28, 2022.

Pursuant to Stock Purchase Agreement, the Company will purchase a total of 62,122,908 shares of common stock, par value $0.01 (the “True Partner Shares”), of True Partner Capital Holding Limited, a Cayman Islands company ( “True Partner”), from Alset EHome and a subsidiary of Alset EHome (the “True Partner Transaction”).

Upon consummation of the True Partner Transaction (the “True Partner Closing”), in exchange for the True Partners Shares, the Company will issue to Alset EHome, an aggregate of 17,570,948 newly issued shares of the Company’s common stock, par value $0.02 per share (the “DSS-TP Shares”).

About True Partner

True Partner is a Hong Kong and U.S. based fund management group listed on the Hong Kong Stock Exchange with a focus on volatility trading in liquid markets. True Partner and its subsidiaries (together as the “True Partner Group”) manages funds and managed accounts on a discretionary basis using a global volatility relative value trading strategy involving the active trading of liquid exchange listed derivatives (including equity index options, large cap single stock options, as well as futures, exchange traded funds and equities) across major markets (including the U.S., Europe and Asia) and different time zones. The True Partner Group’s trading decisions are supported by our in-house proprietary trading platform (embedded with option pricing and volatility surface models) designed for our specific way of trading and which enables real-time pricing of implied volatilities, quantitative comparisons, risk management as well as speedy execution of trades.

| 11 |

Rationale for the True Partner Transaction

Following the closing of the True Partner Transaction, True Partner will be integrated into DSS Securities, Inc. (“DSS Securities”), a wholly-owned subsidiary of the Company. In addition, the True Partner Transaction, and the integration of True Partner into DSS Securities, will greatly enhance the portfolio of the Finance and Asset Management Division of the Company and will allow the Company’s Securities Division to significantly expand its asset management service and capability.

Stockholder Approval Requirement

Our common stock is listed on the NYSE and, as a result, we are subject to the rules of the NYSE. We believe that the Exchange Offer will result in the issuance of more than 20% of our currently outstanding shares of common stock to a related party. As a result, stockholder approval of the issuance is required by Section 312.03 of the NYSE Listing Company Manual. Section 312.03 of the NYSE Listed Company Manual requires an issuer to obtain stockholder approval prior to the issuance of common stock, or of securities convertible into or exercisable for common stock, in any transaction or series of related transactions, if (i) the common stock has, or will have upon issuance, voting power equal to or in excess of 20% of the voting power outstanding before the issuance of such stock or securities convertible into or exchangeable for common stock or (ii) the number of shares of common stock to be issued is, or will be upon issuance, equal to or in excess of 20% of the number of shares of common stock outstanding before the issuance of common stock or securities convertible into or exercisable for common stock.

Stockholder approval of this Proposal No. 1 will constitute stockholder approval for purposes of NYSE Section 312.03.

Effect of the Issuance Proposal No. 1 on Current Stockholders

If the Issuance Proposal No. 1 is adopted, the issuance of such DSS-TP Shares would result in dilution to our stockholders, and would afford our stockholders a smaller percentage interest in the voting power, liquidation value and aggregate book value of the Company.

Interests of Certain Persons In Matters to be Acted Upon

Mr. Heng Fai Ambrose Chan, our director and Executive Chairman, is also Chairman of the Board, Chief Executive Officer, and the largest beneficial owner of the outstanding shares of Alset EHome. As a result, Mr. Chan has an interest in this Proposal 1. Upon the issuance of DSS-TP Shares, Mr. Chan will beneficially own 43,749,580 shares or approximately 43% of the Company’s common stock.

Change of Control of the Company

Currently, Mr. Chan, our Director and Executive Chairman and the Chairman of the Board and Chief Executive Officer of Alset EHome, beneficially owns 26,178,632 or 31.3% of our outstanding common stock. Pursuant to Proposal I, the Company will issue 17,570,948 shares of the Company’s common stock to Alset EHome, and pursuant to Proposal II, the Company will issue 21,366,177 shares to Alset International.

Following the issuance of the shares pursuant to both of the Issuance Proposals, Mr. Chan will beneficially own 65,115,757 or approximately 53% of the Company’s outstanding common stock. Accordingly, the transactions described in the Issuance Proposals herein will result in a change of control of the Company.

Required Stockholder Vote and Recommendation of Our Board of Directors

Proposal 1 requires the affirmative vote of a majority of the votes castshares of our common stock present and in person or by proxy at the meeting for this proposal. AbstentionsMeeting and broker non-votes, if any, are notentitled to vote thereon as of the Record Date, provided that a quorum is present. An abstention is effectively treated as votesa vote cast and therefore will have no effect on this proposal. A broker may vote on the ratification of the independent registered public accounting firm if a beneficial owner does not provide instructions; therefore, no broker non-votes are expected to exist in connection withagainst this proposal.

The advisory vote on executive compensation will be decided by the affirmative vote of a majority of the votes cast on this proposal at the meeting. However, the stockholder vote on this matter will not be binding on our Company or the Board of Directors, and will not be construed as overruling or determining any decision by the Board on executive compensation.

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE

Abstentions and Broker Non-Votes

Broker Non-Votes: If you hold your shares through a bank, broker or other nominee and do not provide voting instructions to that entity, it may vote your shares only on “routine” matters. For “non-routine” matters, the beneficial owner of such shares is required to provide instructions to the bank, broker or other nominee in order for them to be entitled to vote the shares held for the beneficial owner. The proposed ratification of the appointment of Freed Maxick CPA, P.C. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021 is considered a “routine” matter. Accordingly, brokers are entitled to vote uninstructed shares only with respect to the ratification of the appointment of Freed Maxick CPAs, P.C as our independent registered public accounting firm.

If you hold your shares in street name, it is critical that you cast your vote if you want it to count on all matters to be decided at the Annual Meeting.

Abstentions: Abstentions will be counted for purposes of determining whether a quorum is present for the Annual Meeting and will not count as votes cast, and therefore do not affect the vote outcome.

***

You can contact our corporate headquarters, at (585) 500-4669, or send a letter to: Investor Relations, DSS, Inc., 6 Framark Dr., New York, Victor, New York 14564, with any questions about proposals described in this Proxy Statement or how to execute your vote.

“FOR” THIS PROPOSAL NO. 1 — ELECTION OF DIRECTORS1.

Seven directors are to be elected at the Annual Meeting to serve until the next annual meeting of the Company’s stockholders. Unless otherwise instructed, the persons named in the accompanying proxy intend to vote the shares represented by the proxy for the election of the nominees listed below. Although it is not contemplated that any nominee will decline or be unable to serve as a director, in such event, proxies will be voted by the proxy holder for such other persons as may be designated by the Board of Directors, unless the Board of Directors reduces the number of directors to be elected.

PROPOSAL NO. 2- ISSUANCE OF UP TO AN AGGREGATE OF 21,366,177 SHARES OF THE COMPANY’S COMMON STOCK TO ALSET INTERNATIONAL LIMITED PURSUANT TO THE AMRE TRANSACTION

The following table setsProposal

We are asking our stockholders to approve the issuance of up to 21,366,177 Shares our Common Stock to Alset International Limited (“Alset International”) pursuant to and upon the terms and subject to the conditions set forth in the nominees for directorsAssignment and Assumption Agreement entered into by the Company and Alset International on February 25, 2022.

Pursuant to Assignment and Assumption Agreement, the BoardCompany will purchase the Convertible Promissory Note issued by American Medical REIT, Inc. with a principal amount of Directors. Certain biographical information about the nominees as$8,350,000 and accrued but unpaid interest of $367,400 through May 15, 2022 (the “Note”) from Alset International (the “AMRE Transaction”).

Upon consummation of the Record Date can be found above inAMRE Transaction, (the “AMRE Closing”) The Company will issue Alset International, an aggregate 21,366,177 shares of common stock of the section titled “Directors, Executive Officers and Corporate Governance.”

Company, at a price of $0.408 per share (the “DSS-Alset Shares”).

Nominees for DirectorsAbout American Medical REIT, Inc.

AMRE provides financing solutions to leading medical operators by acquiring licensed patient treatment facilities in various communities and delivering reliable, secure, and competitive cash returns to our investors. AMRE focuses on credit worthy single-tenant, single property transactions in the $10-$60M range and portfolio deals of larger scale, having initial rental yield in the 7-9% range and to pay a quarterly dividend up to 8% in annualized yield to the investors.

Rationale for the AMRE Transaction

AMRE currently possesses a growing portfolio of medical properties and is in a position to provide sustainable dividends and long-term value to investors. AMRE has a lucrative business model resilient to macroeconomic fluctuations that could benefit to the Company and its goals.

Stockholder Approval Requirement

Our common stock is listed on the NYSE and, as a result, we are subject to the rules of the NYSE. We believe that the Exchange Offer may result in the issuance of more than 20% of our currently outstanding shares of common stock. As a result, stockholder approval of the issuance is required by Section 312.03 of the NYSE Listing Company Manual. Section 312.03 of the NYSE Listed Company Manual requires an issuer to obtain stockholder approval prior to the issuance of common stock, or of securities convertible into or exercisable for common stock, in any transaction or series of related transactions, if (i) the common stock has, or will have upon issuance, voting power equal to or in excess of 20% of the voting power outstanding before the issuance of such stock or securities convertible into or exchangeable for common stock or (ii) the number of shares of common stock to be issued is, or will be upon issuance, equal to or in excess of 20% of the number of shares of common stock outstanding before the issuance of common stock or securities convertible into or exercisable for common stock.

Stockholder approval of this Proposal No. 2 will constitute stockholder approval for purposes of NYSE Section 312.03.

| 13 |

Effect of the Issuance Proposal No. 2 on Current Stockholders

If the Issuance Proposal No. 2 is adopted, the issuance of such would result in dilution to our stockholders, and would afford our stockholders a smaller percentage interest in the voting power, liquidation value and aggregate book value of the Company.

Interests of Certain Persons In Matters to be Acted Upon

Mr. Heng Fai Ambrose Chan, our director and Executive Chairman, is also Chairman of the Board, Chief Executive Officer, and the largest beneficial owner of the outstanding shares of Alset EHome. As a result, Mr. Chan has an interest in this Proposal No. 2. Upon the issuance of Shares, Mr. Chan will own 47,544,809 or approximately 45% shares of the Company’s outstanding common stock.

Required Stockholder Vote and Recommendation of Our Board of Directors

Director nominees must receiveProposal 2 requires the affirmative vote of a majority of the votesshares of our common stock present and in person or by proxy at the Meeting and entitled to vote thereon as of the Record Date, provided that a quorum is present. An abstention is effectively treated as a vote cast on such director’s election, which means that the nominee must receive more “FOR” votes than “WITHHOLD” votes.against this proposal.

OUR BOARD OF DIRECTORS RECOMMENDS ATHAT YOU VOTE “FOR” THE ELECTION OF ALL THE NOMINEES NAMED ABOVE.

“FOR” THIS PROPOSAL NO. 2.

| 14 |

PROPOSAL NO. 2 —3 RATIFICATION OF THE APPOINTMENT OF TURNER, STONE & COMPANY, LLP AS THE COMPANY’S INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEARS ENDED DECEMBER 31, 2021 AND DECEMBER 31, 2022

The Company’s stockholders are being asked to ratify the Board of Directors’ appointment of Freed Maxick CPAs, P.C.Turner, Stone & Company, L.L.P. as the Company’s independent registered public accounting firm for fiscal year 2021.years ending December 31, 2021 and December 31, 2022.

In the event that the ratification of this selection is not approved by an affirmative majority of the votes cast on the proposal at the Annual Meeting, the Board of Directors will review its future selection of the Company’s independent registered public accounting firm.

Representatives of Freed Maxick CPAs, P.C.Turner, Stone & Company, L.L.P. are not expected to attend the Annual Meeting.

Audit fees consist of fees for professional services rendered for the audit of the Company’s consolidated financial statements included in the Company’s Annual Report on Form 10-K, the review of financial statements included in the Company’s Quarterly Reports on Form 10-Q, and for services that are normally provided by the auditor in connection with statutory and regulatory filings or engagements. The aggregate fees billed for professional services rendered by our principal accountant, Freed Maxick CPAs, P.C.Turner, Stone & Company, L.L.P., for audit and review services for the fiscal years ended December 31, 20202021 and 20192020 were approximately $370,000$75,000 and $154,600,$0, respectively.

The aggregate fees billed for audit related services by our principal accountant, Freed Maxick CPAs, P.C.,Turner, Stone & Company, L.L.P. pertaining to comfort letters related to our registered offerings during the years, consents for related registration statements and the audit of the Company’s employee benefit plan and review of the stand-alone financial statements for one of the Company’s subsidiaries, for the years ended December 31, 20202021 and 20192020 were approximately $98,000$3,000 and $51,450,$0, respectively.

The aggregate fees billed for professional services rendered by our principal accountant, Freed Maxick CPAs, P.C.,Turner, Stone & Company, L.L.P. for tax compliance, tax advice and tax planning during the years ended December 31, 20202021 and 20192020 were approximately $30,000$0 and $29,500,$0, respectively.

There were nowas $16,000 in fees billed for professional services rendered by our principal accountant, Freed Maxick CPAs, P.C.Turner, Stone & Company, L.L.P., for other related services during the years ended December 31, 20202021 and 2019.$1,500 for 2020.

Administration of the Engagement; Pre-Approval of Audit and Permissible Non-Audit Services

The Company’s Audit Committee Charter requires that the Audit Committee establish policies and procedures for pre-approval of all audit or permissible non-audit services provided by the Company’s independent auditors. Our Audit Committee, approved, in advance, all work performed by our principal accountant, Freed Maxick CPAs, P.C.Turner, Stone & Company, L.L.P. These services may include audit services, audit-related services, tax services and other services. The Audit Committee may establish, either on an ongoing or case-by-case basis, pre-approval policies and procedures providing for delegated authority to approve the engagement of the independent registered public accounting firm, provided that the policies and procedures are detailed as to the particular services to be provided, the Audit Committee is informed about each service, and the policies and procedures do not result in the delegation of the Audit Committee’s authority to management. In accordance with these procedures, the Audit Committee pre-approved all services performed by Freed Maxick CPAs, P.C.

Turner, Stone & Company, L.L.P.

Required Stockholder Vote and Recommendation of Our Board of Directors

Ratification of the appointment of our independent registered public accounting firm requires the affirmative vote of a majority of the votes cast at the Annual Meeting, whether in person or by proxy, provided that a quorum is present. An abstention will not be counted for or against the proposal, and therefore will not affect the vote outcome.

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE

“FOR” THE RATIFICATION OF THE APPOINTMENT OF FREED MAXICK CPAs, P.C.TURNER, STONE & COMPANY, LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEARYEARS ENDING DECEMBER 31, 2021.2021 AND DECEMBER 31, 2022

PROPOSAL NO. 3 - ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) requires the Company’s stockholders to have the opportunity to cast a non-binding advisory vote regarding the approval of the compensation disclosed in this Proxy Statement of the Company’s Named Executive Officers included in the summary compensation table and related disclosures. As discussed in the “Executive Compensation” section below, the Company has disclosed the compensation of the Named Executive Officers pursuant to rules adopted by the SEC.

We believe that our compensation policies for the Named Executive Officers are designed to attract, motivate and retain talented executive officers and are aligned with the long-term interests of the Company’s stockholders. This advisory stockholder vote, commonly referred to as a “say-on-pay vote,” gives you as a stockholder the opportunity to approve or not approve the compensation of the Named Executive Officers that is disclosed in this Proxy Statement by voting for or against the following resolution (or by abstaining with respect to the resolution):

RESOLVED, that the stockholders of DSS, Inc. approve all of the compensation of the Company’s executive officers who are named in the Summary Compensation Table of the Company’s 2021 Proxy Statement, as such compensation is disclosed in the Company’s 2021 Proxy Statement pursuant to Item 402 of Regulation S-K, which disclosure includes the Proxy Statement’s Summary Compensation Table and other executive compensation tables and related narrative disclosures.

Because your vote is advisory, it will not be binding on either the Board of Directors or the Company. However, the Company’s Compensation and Management Resources Committee will take into account the outcome of the stockholder vote on this proposal at the Annual Meeting when considering future executive compensation arrangements. In addition, your non-binding advisory votes described in this Proposal 3 will not be construed: (1) as overruling any decision by the Board of Directors, any Board committee or the Company relating to the compensation of the Named Executive Officers, or (2) as creating or changing any fiduciary duties or other duties on the part of the Board of Directors, any Board committee or the Company.

OUR BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” APPROVAL OF THE COMPENSATION OF THE COMPANY’S EXECUTIVE OFFICERS DISCLOSED IN THE SUMMARY COMPENSATION TABLE OF THIS PROXY STATEMENT.

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors and Executive Officers

Our executive officers and directors as of the date of this report are as follows:

Biographical and certain other information concerning the Company’s officers and directors is set forth below. Except for Mr. Heng Fai Ambrose Chan and his son Mr. Tung Moe Chan, there are no familial relationships among any of our directors. Except as indicated below, none of our directors is a director of any other reporting companies. None of our directors has been affiliated with any company that has filed for bankruptcy within the last ten years. We are not aware of any proceedings to which any of our directors, or any associate of any such director is a party adverse to us or any of our subsidiaries or has a material interest adverse to us or any of our subsidiaries. Each executive officer serves at the pleasure of the Board of Directors.

| Name | Age | Director/Officer Since | Principal Occupation or Occupations and Directorships | |||

| Frank D. Heuszel | 65 | 2018 | Mr. Frank D. Heuszel has served as a director of the Company since July 30, 2018, and from July 2018 to April 2019, he served as chairman of the Company’s Audit Committee. From April 17, 2019 until October 28, 2020, he served as both the Company’s Chief Executive Officer and Interim Chief Financial Officer. Since then, he serves only as the Chief Executive Officer and a director of the Company Mr. Heuszel has extensive expertise in a wide array of strategic, business, turnaround, and regulatory matters across several industries as a result of his executive management, educational, and operational experience. Prior to joining DSS, Mr. Heuszel had a very successful career in commercial banking. For over 35 years, Mr. Heuszel served in many senior executive roles with major US and international banking organizations. As a banker Mr. Heuszel has served as General Counsel, Director of Special Assets, Credit Officer, Chief Financial Officer and Auditor. Mr. Heuszel also operated a successful law practice focused on litigation, corporate restructures, and mergers and acquisitions, and collections. In addition to being an attorney and executive manager, Mr. Heuszel is also a Certified Public Accountant (retired), and a Certified Internal Auditor (retired). Mr. Heuszel graduated from The University of Texas at Austin and from The South Texas College of Law, Houston.

On September 29, 2020, Mr. Heuszel was elected to the Board of Directors of the publicly traded company, Sharing Services Global Corporation (“Sharing Services”), which is an OTCQB public company. He continues to serve on the Sharing Services board. DSS currently owns approximately 46.7% of the outstanding shares of Sharing Services, a diversified company dedicated to maximizing shareholder value through the acquisition and development of innovative companies, products, and technologies in the direct selling industry. |

| Todd D. Macko | 49 | 2020 | Mr. Todd Macko was promoted to Interim Chief Financial Officer effective October 28, 2020 and was appointed Chief Financial Officer on August 16, 2021. Mr. Macko previously served as the Vice President of Finance of the Company. As the Vice President of Finance, Mr. Macko’s responsibilities included assisting DSS’s Interim Chief Financial Officer in all aspects of financial and regulatory reporting. In addition, his responsibilities included the day-to-day management of the Company’s Accounting and Finance team and financial leadership in the directing and improving of accounting, reporting, audit, and tax activities. Prior to his role as Vice President of Finance for the Company, Mr. Macko joined the wholly owned subsidiary of DSS, Premier Packaging Corporation in January 2019, as its Vice President of Finance.

Mr. Macko is a Certified Public Accountant with over 25 years of public and corporate financial management, business leadership and corporate strategy. Mr. Macko brings a wealth of experience with strengths in financial planning and analysis, business process re-engineering, budgeting, merger and acquisitions, financial reporting systems, project evaluation and treasury and capital management.

Prior to joining the Company, Mr. Macko served as the Corporate Controller for Baldwin Richardson Foods, a leading custom ingredients manufacturer for the food and beverage industry from November 2015 until January 2019. Prior to that, Mr. Macko served as the Controller for The Outdoor Group, LLC., Genesis Vision, Inc., Complemar Partners, Inc., and Level 3 Communications, Inc. Mr. Macko obtained his Bachelor of Science in Accounting from Rochester Institute of Technology. | |||

| Heng Fai Ambrose Chan | 76 | 2017 | Mr. Heng Fai Ambrose Chan has served as a director of the Company since February 12, 2017 and became Chairman of the Board of Directors on March 27, 2019. He has also served as an officer of the Company’s wholly-owned subsidiary, DSS International Inc., since July of 2017. Mr. Chan is an expert in banking and finance, with years of experience in the industry. Mr. Chan has restructured 35 companies in various industries and countries over the past 40 years. Mr. Chan currently serves as the Chairman and Chief Executive Officer of Alset International Ltd. (formerly known as Singapore eDevelopment Limited (SED))(“Alset International”), a publicly traded company on the Singapore Stock Exchange. He also serves as a director of BMI Capital Partners International Ltd., a wholly-owned subsidiary of Alset International. Mr. Chan also serves on the board of Sharing Services Global Corporation, which is an OTCQB public company. Mr. Chan has served as a member of the Board of Directors of LiquidValue Development Inc. since January 10, 2017, and has served as Co-Chief Executive Officer of LiquidValue Development Inc. since December 29, 2017. Mr. Chan has also served as a non-executive director of Holista CollTech Ltd., a publicly traded company on the Australian Securities Exchange, since July 2013 Mr. Chan has served as a director of OptimumBank Holdings, Inc., a publicly traded company on the Nasdaq Capital Markets and Optimum Bank since June 2018.

Mr. Chan formerly served as (i) Managing Chairman of Heng Fai Enterprises Limited (now known as ZH International Holdings Limited) which trades on the Hong Kong Stock Exchange; (ii) the Managing Director of SGX Catalist-listed SingHaiyi Group Ltd., which under his leadership, transformed from a failing store-fixed business provider with net asset value of less than $10 million into a property trading and investment company and finally to a property development company with net asset value over $150 million before Mr. Chan ceded his controlling interest in late 2012; (iii) the Executive Chairman of China Gas Holdings Limited, a formerly failing fashion retail company listed on the Hong Kong Stock Exchange, which under his direction, was restructured to become one of the few large participants in the investment in and operation of city gas pipeline infrastructure in China; (iv) a director of Global Med Technologies, Inc., a medical company listed on NASDAQ engaged in the design, development, marketing and support information for management software products for healthcare-related facilities; (v) a director of Skywest Limited, an ASX-listed airline company; and (vi) the Chairman and Director of American Pacific Bank. In 1987, Mr. Chan acquired American Pacific Bank, a full-service U.S. commercial bank, and brought it out of bankruptcy. He recapitalized, refocused and grew the bank’s operations. Under his guidance it became a NASDAQ-listed high asset quality bank with zero loan losses for over five consecutive years before it was ultimately bought and merged into Riverview Bancorp Inc. Mr. Chan’s international business contacts and experience qualify him to serve on our Board of Directors. |

| Sassuan (Samson) Lee | 50 | 2019 | Mr. Sassuan (Samson) Lee has served as a director of the Company since August 5, 2019. He co-founded STO Global X, a technology and service provider for security token exchange solutions, in December 2017. He has also served as the Chief Crypto-Economic Advisor for Gibraltar Stock Exchange and Gibraltar Blockchain Exchange since September 2017. In November 2016, Mr. Lee founded Coinstreet Partners, a consultancy firm focused on blockchain, fintech, cryptocurrency and digital assets, and has served as its Chief Executive Officer since inception. Mr. Lee currently serves on the board of directors of Sharing Services Global Corporation, which is an OTCQB public company. Mr. Lee previously served as Managing Director at uCast Global Asia from December 2015 through November 2016. Mr. Lee also served as the Executive Vice President of the Greater China region at Movideo from June 2015 through December 2015 and as Vice President and General Manager of the Greater China and South Asia Pacific regions at NeuLion Inc. from July 2008 through June 2015. Mr. Lee received his Bachelor of Commerce degree from the University of Toronto and his MBA and MS degrees from the Hong Kong University of Science and Technology. Mr. Lee’s extensive experience and recognized expertise in the fields of technology, blockchain, cryptocurrency and fintech, combined with his experience as Chief Executive Officer and Managing Director of successful international businesses qualifies him to serve on the Company’s Board of Directors and as a member of the Audit Committee and the Nominating and Corporate Governance Committee and the Chairman of the Compensation and Management Resources Committee. | |||

| Wai Leung William Wu | 55 | 2019 | Mr. Wai Leung William Wu has served as a director of the Company since October 20, 2019. He served as the managing director of Investment Banking at Glory Sun Securities Limited since January 2019. Mr. Wu previously served as the executive director and chief executive officer of Power Financial Group Limited from November 2017 to January 2019. Mr. Wu has served as a director of Asia Allied Infrastructure Holdings Limited since February 2015. Mr. Wu previously served as a director and chief executive officer of RHB Hong Kong Limited from April 2011 to October 2017. Mr. Wu served as the chief executive officer of SW Kingsway Capital Holdings Limited (now known as Sunwah Kingsway Capital Holdings Limited) from April 2006 to September 2010. Mr. Wu holds a Bachelor of Business Administration degree and a Master of Business Administration degree of Simon Fraser University in Canada. He was qualified as a chartered financial analyst of The Institute of Chartered Financial Analysts in 1996.

Mr. Wu previously worked for a number of international investment banks and possesses over 26 years of experience in the investment banking, capital markets, institutional broking and direct investment businesses. He is a registered license holder to carry out Type 6 (advising on corporate finance) and Type 9 (asset management) regulated activities under the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). Mr. Wu has served as a member of the Guangxi Zhuang Autonomous Region Committee of the Chinese People’s Political Consultative Conference in January 2013. Mr. Wu’s experience in banking, capital markets, investment banking, Asian economic and banking dynamics, and education in corporate finance and asset management qualifies him to serve on the Company’s Board of Directors and as a member of the Audit Committee and the Compensation and Management Resources Committee. |

|

Board of Directors and Committees

The Company has determined that each of Mr. John “JT” Thatch, Mr. Wai Leung William Wu, Mr. Sassuan (Samson) Lee and Mr. José Escudero qualify as independent directors (as defined under Section 803 of the NYSE American LLC Company Guide).

In fiscal 2020, each of the Company’s independent directors attended or participated in 96% or more of the aggregate of (i) the total number of meetings of the Board of Directors held during the period in which each such director served as a director and (ii) the total number of meetings held by all committees of the Board of Directors during the period in which each such director served on such committee. During the fiscal year ended December 31, 2020, the Board held four meetings and acted by written consent on six occasions.

On December 9, 2019, the Board appointed Mr. Thatch as the Lead Independent Director, effective immediately. Mr. Thatch will serve as the Lead Independent Director until his successor is duly appointed and qualified, or until his earlier removal or resignation or such time as he is no longer considered an independent director under the New York Stock Exchange listing standards. Mr. Thatch’s authority, responsibilities, and duties as the Lead Independent Director include the following: (i) preside at all meetings of the Board at which the Chairman of the Board is not present, at all meetings of the independent directors and at all executive sessions of the independent directors, (ii) have a reasonable opportunity to review and comment on Board meeting agendas, (iii) serve as a liaison between the Chairman of the Board and the other members of the Board, (iv) have the authority to call special meetings of the Board and of the independent directors, and (v) perform such other duties as the Board may from time to time delegate.

On August 19, 2021, Lo Wah Wai resigned as a member of the Board. Mr. Lo’s resignation was accepted and became effective August 20, 2021. Mr. Lo did not resign from the Board as a result of any disagreement related to the Company’s operations, policies or practices but rather due to his “heavy workload and commitment in other corporations”. The Company will not appoint a successor to Mr. Lo and the size of the Board will remain at seven directors.

The Company has separately designated an Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee held four meetings in 2020 and did not act by written consent in 2020. The Audit Committee is responsible for, among other things, the appointment, compensation, removal and oversight of the work of the Company’s independent registered public accounting firm, overseeing the accounting and financial reporting process of the Company, and reviewing related person transactions. As of December 31, 2020, the Audit Committee was comprised of Mr. Thatch, Mr. Wu and Mr. Lee, each of whom continues to serve on the Audit Committee. Each of Mr. Wu, Mr. Thatch and Mr. Lee is qualified as a “financial expert” as defined in Item 407 under Regulation S-K of the Securities Act of 1933, as amended (the “Securities Act”) Each of the members of the Audit Committee is an independent director (as defined under Section 803 of the NYSE American LLC Company Guide). Mr. Thatch serves as Chairman of the Audit Committee. The Audit Committee operates under a written charter adopted by the Board of Directors, which can be found in the Investors/Corporate Governance section of our web site, www.dsssecure.com.

Compensation and Management Resources Committee

The purpose of the Compensation and Management Resources Committee is to assist the Board in discharging its responsibilities relating to executive compensation, succession planning for the Company’s executive team, and to reviewing and making recommendations to the Board regarding employee benefit policies and programs, incentive compensation plans and equity-based plans. The Compensation and Management Resources Committee held two meetings in 2020.

The Compensation and Management Resources Committee is responsible for, among other things, (a) reviewing all compensation arrangements for the executive officers of the Company and (b) administering the Company’s stock option plans. The Compensation and Management Resources Committee consists of Mr. José Escudero, Mr. Wai Leung William Wu and Mr. Sassuan (Samson) Lee, with Mr. Lee as the Chairman. Each of the members of the Compensation and Management Resources Committee is an independent director (as defined under Section 803 of the NYSE American Company Guide). The Compensation and Management Resource Committee operates under a written charter adopted by the Board of Directors, which can be found in the Investors/Corporate Governance section of our web site, www.dsssecure.com.

The duties and responsibilities of the Compensation and Management Resources Committee in accordance with its charter are to review and discuss with management and the Board the objectives, philosophy, structure, cost and administration of the Company’s executive compensation and employee benefit policies and programs; no less than annually, review and approve, with respect to the Chief Executive Officer and the other executive officers (a) all elements of compensation, (b) incentive targets, (c) any employment agreements, severance agreements and change in control agreements or provisions, in each case as, when and if appropriate, and (d) any special or supplemental benefits; make recommendations to the Board with respect to the Company’s major long-term incentive plans applicable to directors, executives and/or non-executive employees of the Company and approve (a) individual annual or periodic equity-based awards for the Chief Executive Officer and other executive officers and (b) an annual pool of awards for other employees with guidelines for the administration and allocation of such awards; recommend to the Board for its approval a succession plan for the Chief Executive Officer, addressing the policies and principles for selecting a successor to the Chief Executive Officer, both in an emergency situation and in the ordinary course of business; review programs created and maintained by management for the development and succession of other executive officers and any other individuals identified by management or the Compensation and Management Resources Committee; review the establishment, amendment and termination of employee benefits plans, review employee benefit plan operations and administration; and any other duties or responsibilities expressly delegated to the Compensation and Management Resources Committee by the Board from time to time relating to the Committee’s purpose.

The Compensation and Management Resources Committee may request any officer or employee of the Company or the Company’s outside counsel to attend a meeting of the Compensation and Management Resources Committee or to meet with any members of, or consultants to, the Compensation and Management Resources Committee. The Company’s Chief Executive Officer does not attend any portion of a meeting where the Chief Executive Officer’s performance or compensation is discussed, unless specifically invited by the Compensation and Management Resources Committee.